Balance Sheet Report

This article gives a brief overview of the Balance Sheet report.

The main purpose of a Balance Sheet report is to ensure that all of your bookkeeping entries have utilized the “double-entry” accounting method.

The double-entry method ensures that at least one “debit” and one “credit” have been utilized to “balance” out your books. Remember, every financial transaction (such as a bank deposit, sales receipt, vendor bill payment, etc) should always affect at least two accounts in your books, and thus the overall entry should balance out (the total debits should equal the total credits).

Today’s bookkeeping software should warn you (at least) when a transaction’s total debits and credits do not balance.

A Balance Sheet report is also very useful in that you obtain the current total value of your company. This is done by a “snapshot” of the current value of your Assets, Liabilities and Equity that your company owns. Perhaps someday, when you try to obtain a business loan, you may be asked by the bank for a current Balance Sheet report that represents your company.

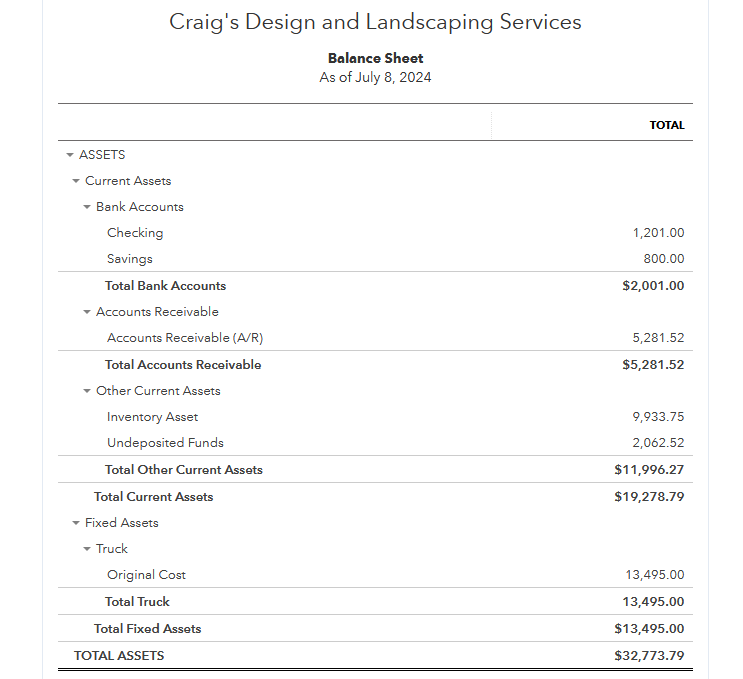

So, without further ado, here is a simple example of a Balance Sheet report:

This first section is the “Assets” section of a Balance Sheet report:

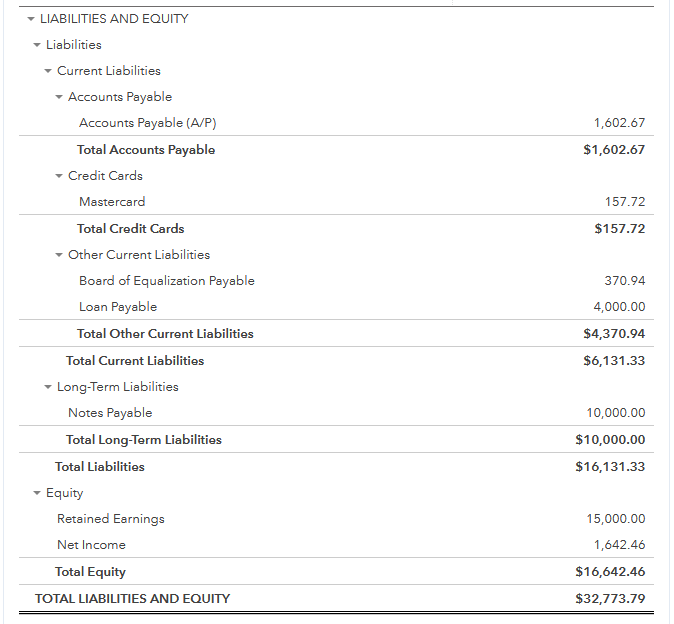

This next section is the “Liabilities” & “Equity” section of the same Balance Sheet report:

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.