Close Construction in Progress to COGS

This article deals with posting a closing Construction in Progress journal entry as a result of selling, for example, a Spec built home that, you as the homebuilder, have sold and are trying to close out in your books.

During the course of the build of a Spec home, you would post all associated costs to an asset account, typically titled “Construction In Progress” or something very similar. When the entire build is finally complete, then it would be time to actually recognize all of these associated costs on your Income Statement (Profit & Loss). So, to do this, you have to move all of the associated costs that had been capitalized within your Construction In Progress (CIP) account, on over to Cost of Goods Sold type of expense accounts; this can be accomplished with the posting of a journal entry.

So, let’s get started and here is a scenario:

You recently sold a Spec built home and now you are trying to recognize your costs to build the home. Typically, there are about five main categories of costs to build a Spec home:

- Materials

- Labor

- Closing Costs (when you purchased, say a vacant Lot)

- Equipment Rental

- Loan Interest Expenses (for a Construction Loan)

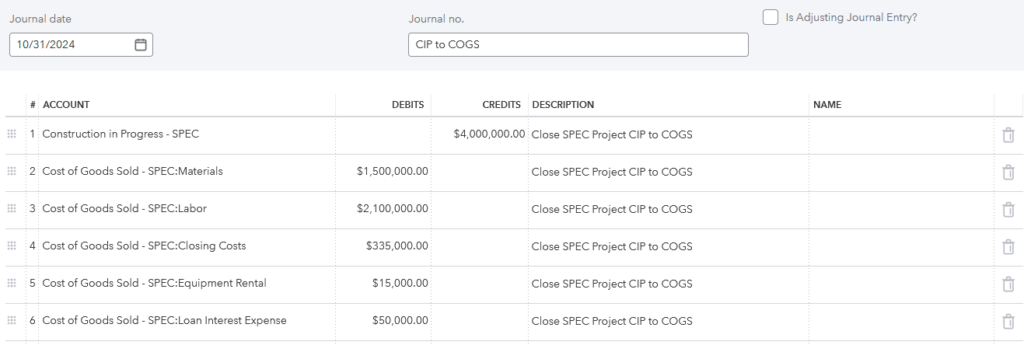

Here is the example journal entry. Note: Total costs were $4,000,000, so we need to break this out into the appropriate COGS categories:

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.