Home Sale Journal Entry

This article deals with posting journal entries as a result of selling, for example, a spec built home that, you as the homebuilder, have sold and are trying to close out in your books.

The main document that you will need to post the income, closing costs, cash deposit and reduction to zero out any associated loans will be the Settlement Closing Statement (such as an ALTA settlement statement); typically you only need the page (at the beginning) that lists all of the debits and credits for the seller. Please note: this article is not dealing with closing out any Construction-In-Progress accounts.

So, let’s get started and here is a scenario:

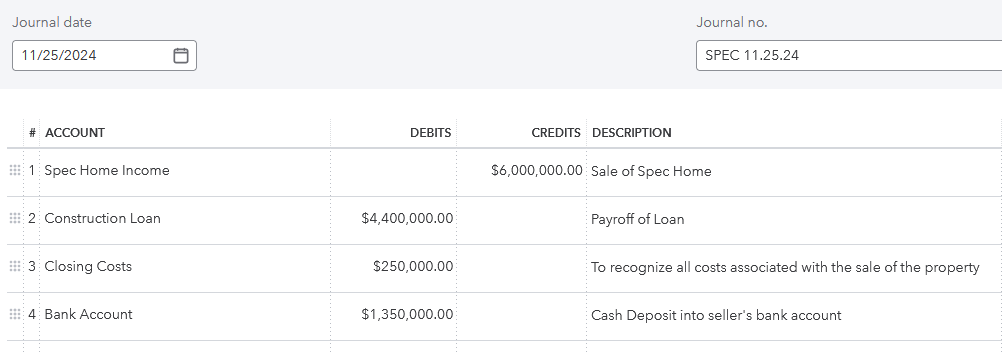

You recently sold a Spec-built home for $6,000,000. The closing costs (which I include to be brokerage charges, title fees, property tax proration and any other fee in this realm dealing with the sale of a property) are $250,000. The loan payoff was $4,400,000. The cash settlement (the cash that was deposited into your account) was $1,350,000.

Here is the journal entry:

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.