Reconciliations Report in QuickBooks Online

This article addresses the benefits of reviewing a bank Reconciliations report.

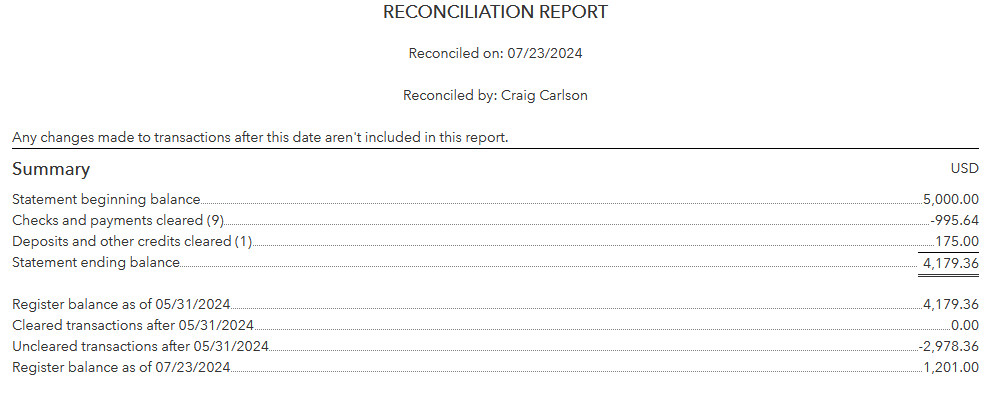

In QuickBooks Online, a bank reconciliations report will automatically be created once you have completed an official bank reconciliation that recognizes:

- Beginning bank balance for the reconciled period.

- Ending bank balance for the reconciled period.

- All cleared and uncleared transactions during this reconciliation event.

A bank reconciliation is a must-do process that should be completed to verify your banking activity within a certain period of time.

Thus, in QuickBooks Online, a bank reconciliations report will reflect your work completed once you have trued up and reconciled your records to the bank’s records.

So, let’s briefly take a look at some of the key aspects in a bank reconciliations report generated from QuickBooks Online:

This first image gives you some important information. Notice the statement beginning balance and the statement ending balance. In between are all of the transactions that you cleared to match with the bank records. Then there is your QuickBooks Online (register) balance as of a certain date; notice that this register balance does indeed match the ending balance as well (for the same date). This will NOT always be the case as, for instance, sometimes you have check payments mailed out to vendors that still go uncashed by the vendors as of this ending date.

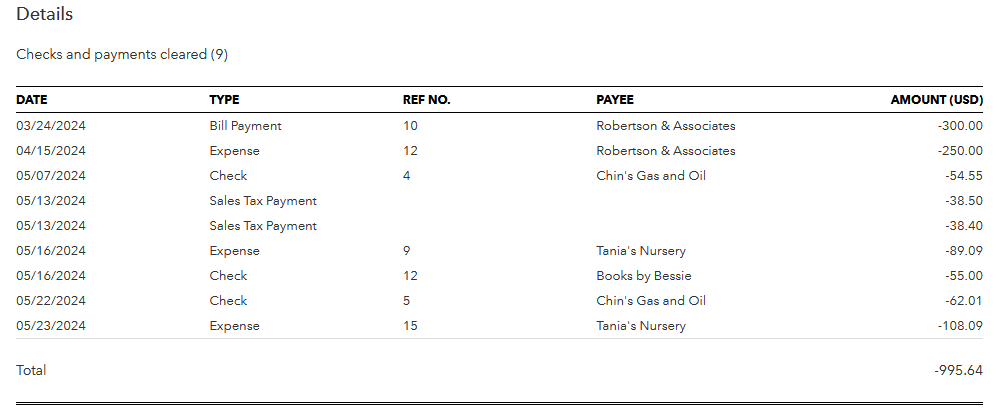

The next image is simply just a list of payments to vendors that you cleared (matched) to your bank records:

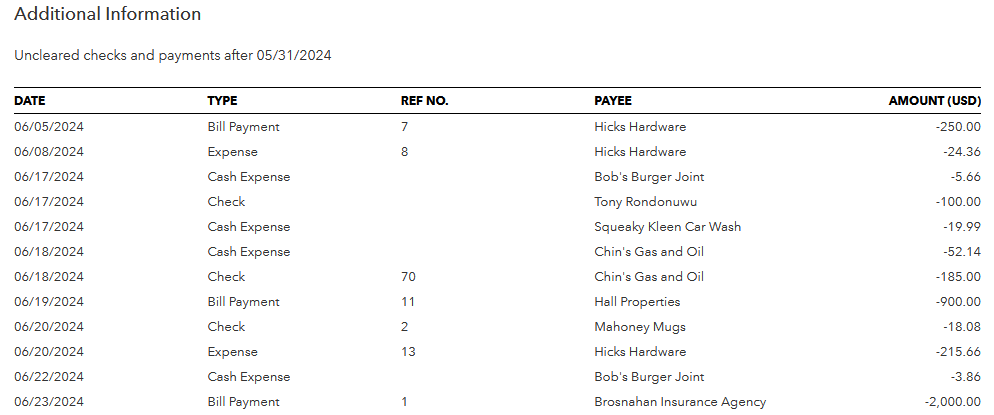

Finally, this last image is a list of payments to vendors that still have NOT cleared your bank as of the ending date:

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.