Spec Home – Lot Purchase

This article deals with your purchase of a Lot (Portion of Land) for the purposes of building a Spec Home (on it) in the near future.

A Spec home’s building costs are typically going to be capitalized and converted to COGS upon sale of the completed build. However, the purchase of a Lot (Portion of Land on which the Spec home was built) may not necessarily go into the exact same capitalized Construction in Progress asset account as all of the other build costs will go. Instead, land can simply be looked at as Inventory instead, however, keep in mind, that the completed build is ALSO going to be inventory until you sell it.

I would strongly suggest you consult with your C.P.A. to determine exactly how you want to treat the purchase of land for accounting purposes for your particular business.

BOTH Land and Spec Home Build Costs are indeed Assets on your Balance sheet; however, you probably should determine if you want to separate the land costs and treat as inventory in and of itself, until the build is complete (and hopefully sells immediately upon the completion of the build).

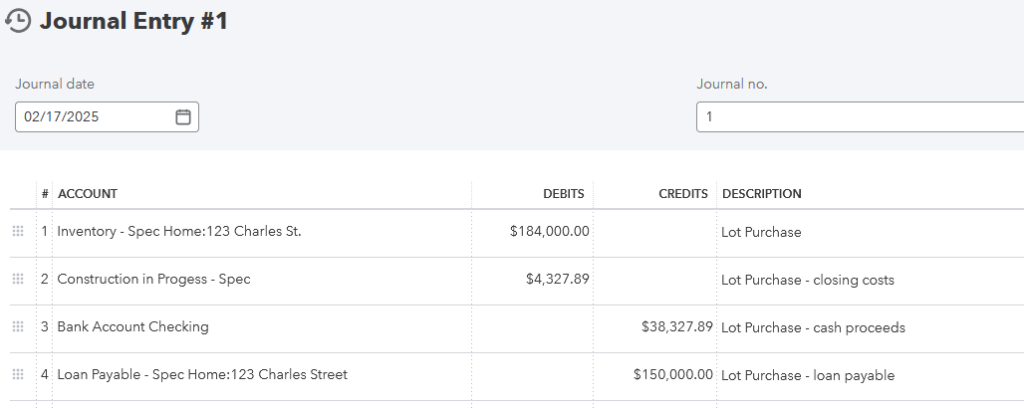

In any case, for the purpose of the purchase of a portion of land (to sell later to earn income), here is a sample journal entry that accounts for:

- Posting Inventory – for the sole purpose of selling to earn a profit

- Capitalizing the associated Closing Costs

- Bank funds proceeds for the purchase

- Loan Payable for the purchase

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.