Trial Balance Report

This article addresses the Trial Balance report as processed from QuickBooks Online.

The Trial Balance report is mainly an Accountant’s report that verifies the double-entry accounting method in your bookkeeping system.

A Trial Balance verifies that the total dollar amount of debits that were utilized in your double-entry accounting system matches, exactly, the total dollar amount of the corresponding credits, within a specific range of time.

The Trial Balance report will show:

- Balance of all of your Balance Sheet accounts as of a certain date.

- Balance of your Profit & Loss accounts, also as of a certain date, but, remember, in QuickBooks, these accounts automatically get reset to zero at the beginning of each fiscal year.

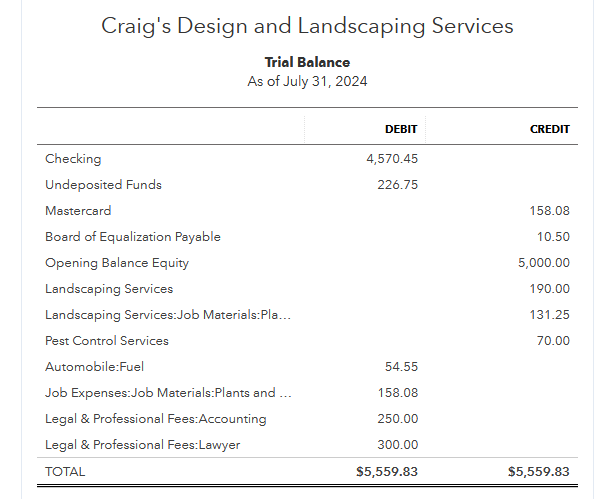

So, to help explain further, let’s review two Trial Balance Reports below.

This first Trial Balance report shows all of your account balances as of 7.31.24. You will notice the Balance Sheet accounts in the top section of this report, then the Profit & Loss accounts in the lower half of this report.

Please Note:

- The balances of the Profit & Loss accounts were as a result of activity that occurred between 1.1.24 – 7.31.24.

- This is a cash-based report only, so no receivables or payables are on this report.

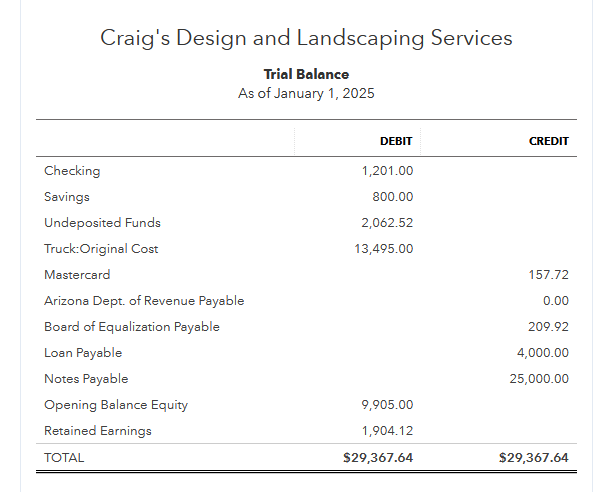

Finally, this next Trial Balance report shows accounts balances as of 1.1.25.

Please Note:

- The fiscal year for this company begins on January 1st of each year. This means only Profit & Loss activity that occurred on 1.1.25 is shown on this report (which there was no business activity posted on this date). Remember, QuickBooks automatically resets these Profit & Loss accounts to zero at the end of each company’s fiscal year. The net sum of the Profit & Loss activity gets posted to an equity account called Retained Earnings.

- Notice this report below now has a Retained Earning amount (this company was brand new in 2024).

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.