Unpaid Bills Report

This article addresses the benefits of reviewing an Unpaid (vendor) Bills report in comparison to a typical Accounts Payables report.

Most of the times small business owners are familiar with the term Accounts Payables and thus will process the corresponding named report in a bookkeeping software to ascertain which vendors they still owe money to.

However, to be a little more creative, you can also process a similar report in QuickBooks entitled “Unpaid Bills” to review your payables from a different perspective. A different perspective can be especially helpful if you have a lot of payables from months and years past still open in your books.

So, let’s compare three reports (from QuickBooks Online):

- Accounts Payables Summary

- Accounts Payables Detail

- Unpaid Bills

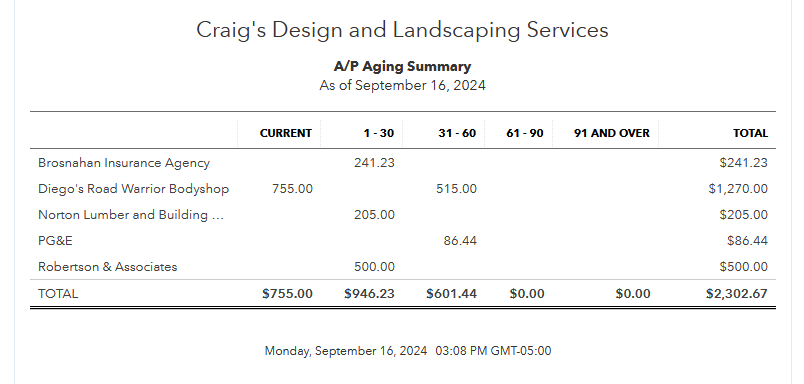

This first report is an Accounts Payables Summary report. Notice that there is a column breakdown by period of time. This report may be helpful to quickly ascertain which vendors you are the furthest behind in your payments to them:

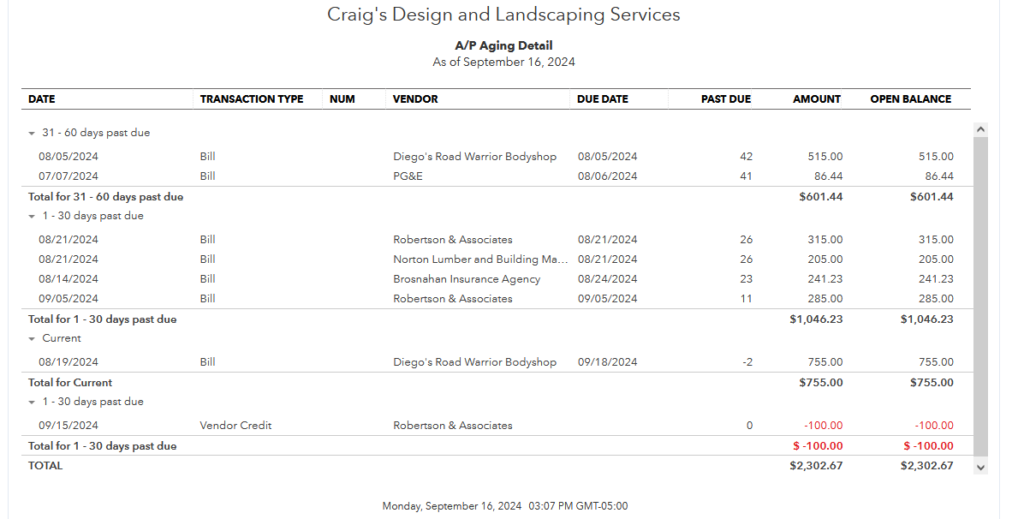

The next report below is an Accounts Payables Detail report. Notice this report is again sorted by period of time, but from rows instead of columns:

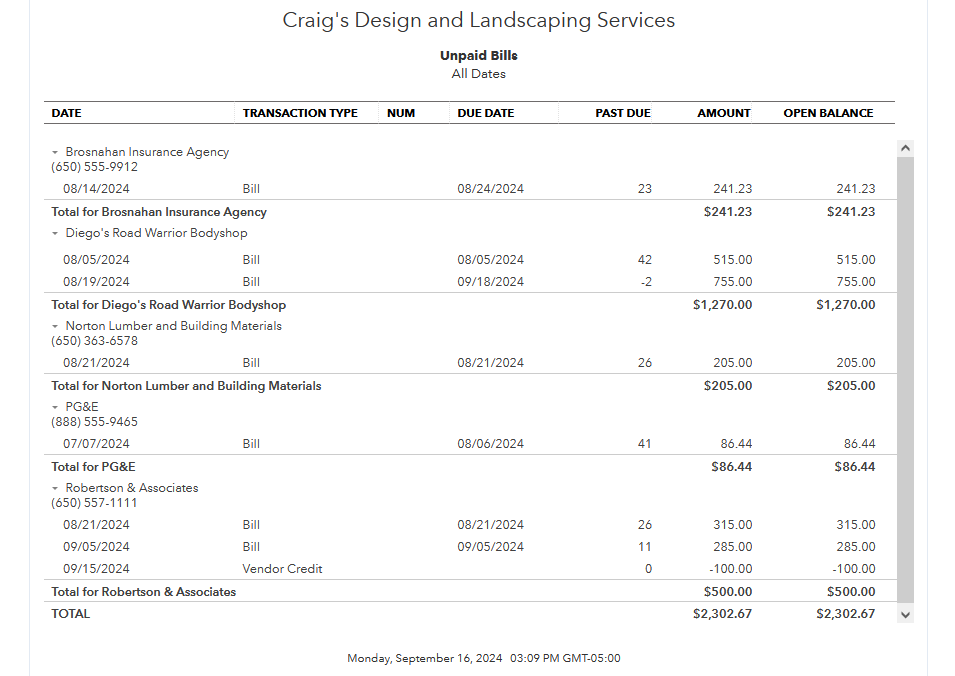

Now, the last report below, is an example of an Unpaid Bills report (utilizing the same data as the above two reports).

Notice that this report is very clear as to whom you owe money to. The reason is this report is sorted only by vendor name. This report can be very helpful for multiple reasons:

- It will breakdown if you owe a vendor for more than one bill and also will separate out all of the credits on file for this vendor as well.

- If you have a lengthy list of vendors, you can use this report to quickly ascertain the status of a particular vendor whom you are inquiring of at that time.

- You can use this report to help apply specific credits to specific bills; that way it can help close out all known open issues with this vendor.

- You can also customize this report to show BOTH the original amount billed and the remaining open balance of that particular bill.

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.