Reports for Insurance Audits

This article addresses two popular financial reports that insurance auditors typically request from a business for general liability purposes (Also known as an Insurance Premium Audit).

Please Note: Your particular insurance auditor may request information such as:

- Sales/Receipts

- Financials including the P&L

- OCIP Sales/Cost by Project

- Direct Labor Costs as a percentage of Gross Receipts

- Payroll Summary Report

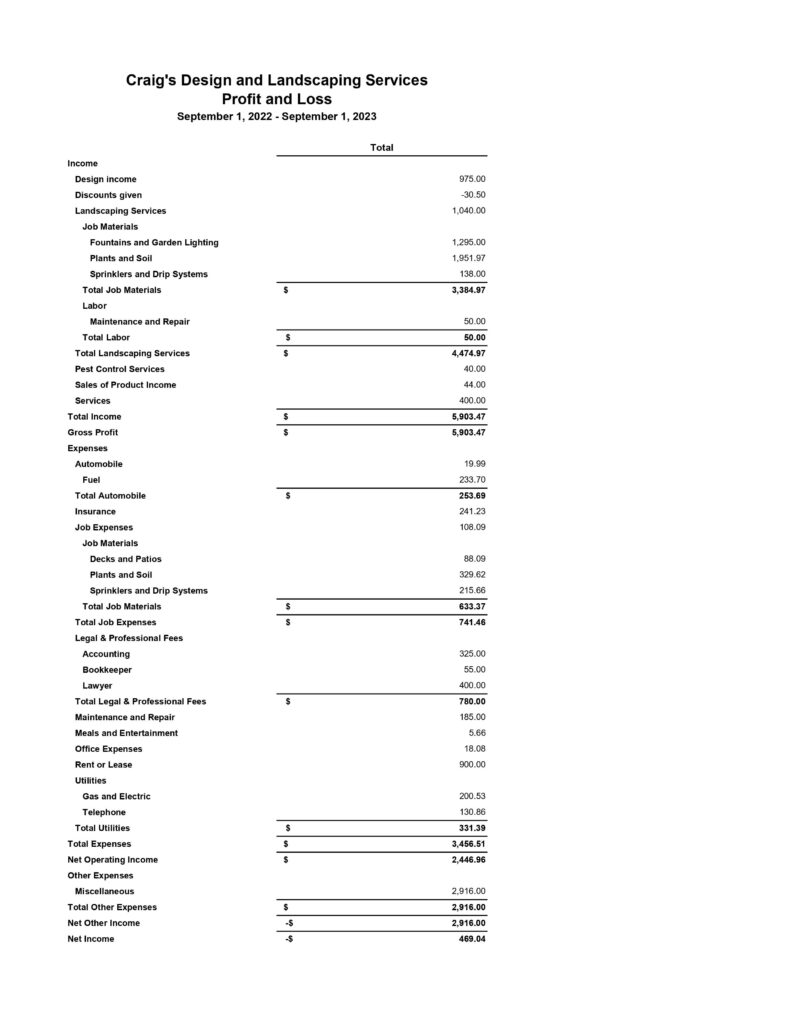

Typically, however, at the very least, the two most popular financial reports submitted for insurance audit reasons are:

- Income Statement

- Direct (as opposed to overhead) Labor Expenses

The date range of information requested will typically be one year, so pay attention to the exact date range as requested by the auditor.

So, without further delay, here is an example of an Income Statement:

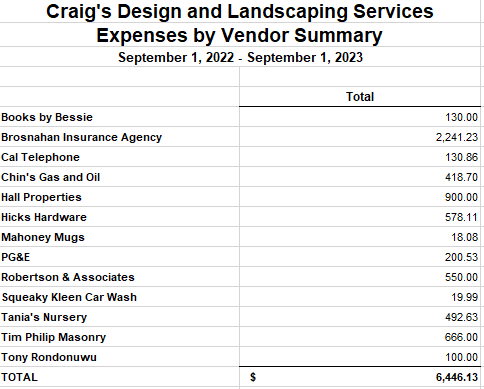

And, secondly, here is an example of a Vendor Expenses Summary Report, (Notice some of these vendors listed are obvious overhead expenses and probably should be removed from this list):

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.