If you are receiving both check and cash payments from customers, then you will probably be depositing multiple payments during one trip to the bank.

To post the entry in your bookkeeping, this requires the use of the undeposited funds account in QuickBooks Online. This particular function can be confusing to understand and utilize in QuickBooks Online; this is mainly because QuickBooks Online does not display a separate pop-up window, within the Undeposited Funds feature, that keeps the undeposited funds separate from the main undeposited funds function:

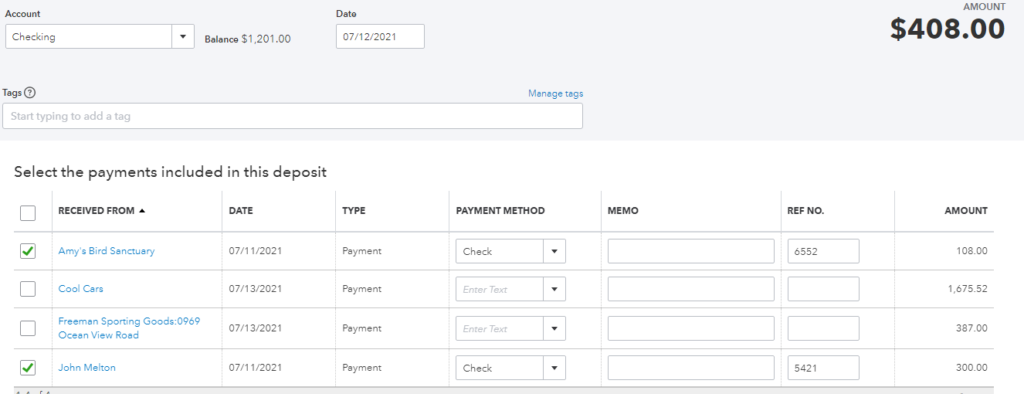

As you can see from the above screen-shot, the total booked deposit is $408 and it comprises ONLY those two check-marked customer payments ($300 + $108). The remaining two unchecked customer payments STILL NEED to be deposited into your bank account.

A separate pop-up window would exclude those two unchecked payments (from your view) and thus (with the help of a separate pop-up window (such as seen in QuickBooks Desktop), when I review this already posted $408 deposit in the future, I will only see the two payments ($300 + $108) that comprised this total $408 and NOT any unchecked payments.

See unchecked and check-marked payments on the same screen within an already-posted deposit can be quite confusing if you are not experienced in posting multiple payments within one deposit in QuickBooks Online.

So, overall, just be careful on what is check-marked and what is unchecked and also I would advise to never leave any payments undeposited in your QuickBooks Online bookkeeping.

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.