When CPA’s Ask for the Financial Statements

This article addresses what to do when your Accountant requests the “financial statements” regarding your business activities.

Sometimes your CPA may not be very specific in these requests, however, typically the financial statements are what I like to call, The Big 3:

- Balance Sheet

- Profit & Loss

- General Ledger

Be sure, however, that you do clarify with your CPA as to what method of accounting they would like to see the numbers: Cash or Accrual basis.

So, below are brief snap-shot examples of the big 3 financial statements that you are most likely going to have to submit to an Accountant at some point in your business life.

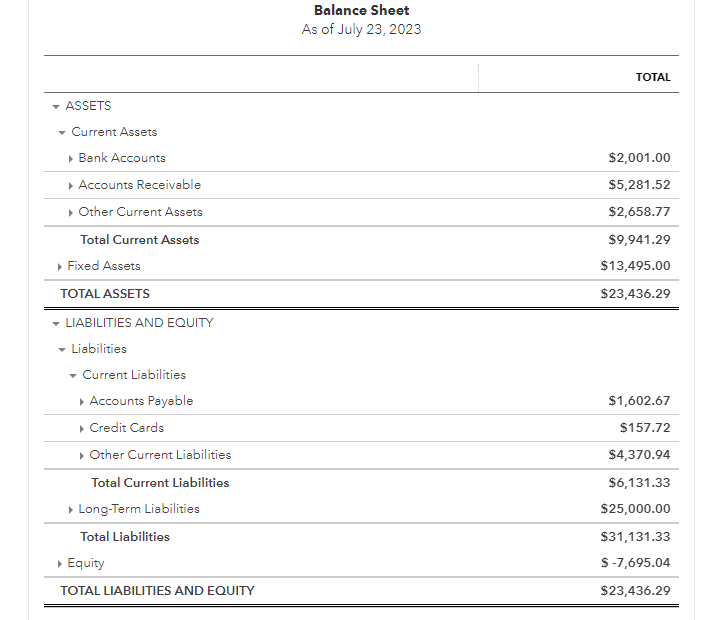

1st: Here is an example of a Balance Sheet. This is giving to you a snap-shot, as of certain date, the total value of your assets, liabilities and equity.

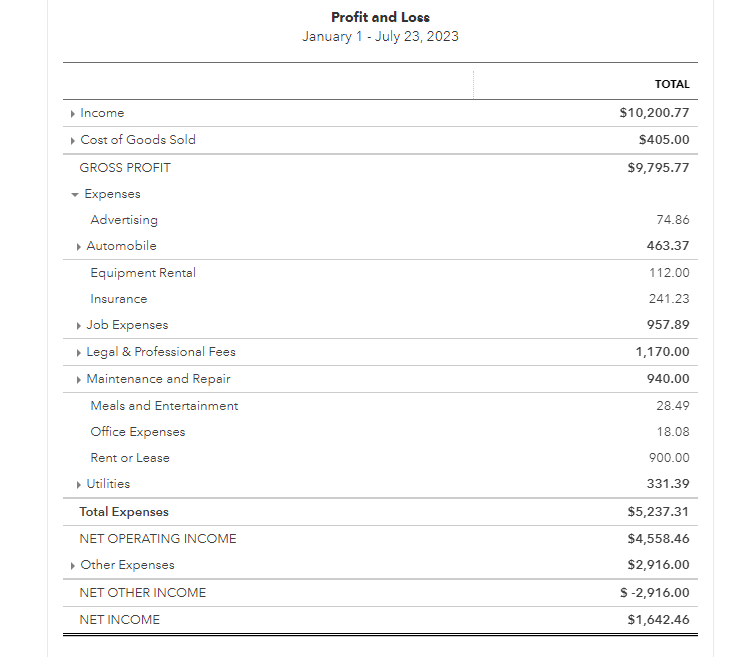

2nd: The Profit & Loss. This is the net result of your business activities as of a certain period (or range) of time. This is letting the viewer of the report know if your business was profitable or not during this period of time.

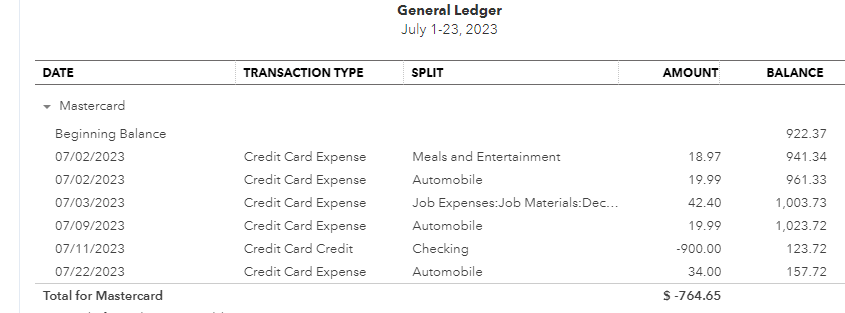

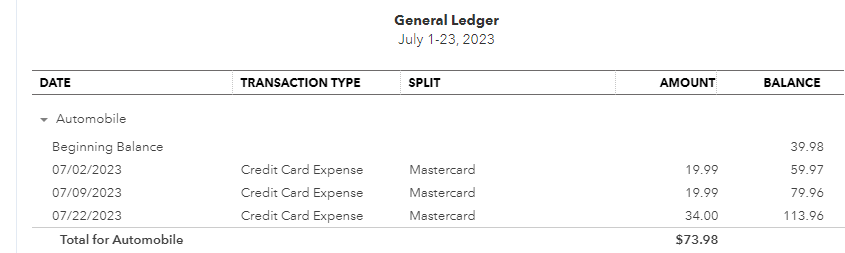

3rd: The General Ledger. This will be a detailed view of all of the activities that occurred in all of your Balance Sheet and Profit & Loss accounts during a period of time. So, the below examples are what occurred within the Mastercard liability account (on the Balance Sheet) and the Automobile expense account (on the Profit & Loss statement) during the period from July 1 – July 23.

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.