Expenses by Vendor Summary Report

This article addresses the benefits of reviewing a Vendor Expenses Summary report.

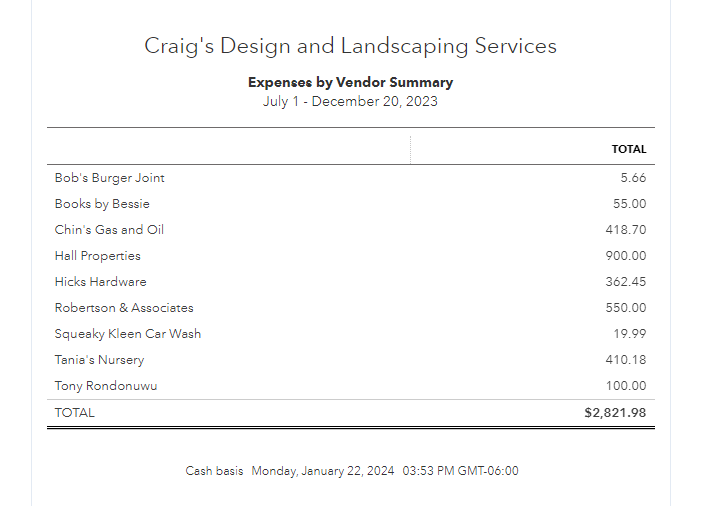

The Vendor Expenses Summary report in QuickBooks will give you information regarding how much money was spent on each vendor within a given time period. The report can be processed in both cash and accrual basis.

Provided that you actually fill in the vendor name field within each expenditure type of transaction, this report can be useful for you to know where your money is going and perhaps to whom are the biggest payouts going to within a certain time period.

This report should encompass all payment types including:

- Debits (such as ACH and wire)

- Credit Cards

- Zelle

- Paypal

- Etc.

There is one important caveat in this report in that you do NOT get results here if you are paying vendors but are booking the payments to an asset or liability type of account in your bookkeeping. For example, let’s say you are building a speculative home and all expenditures are being booked to a Works-In-Progress type of asset account. Thus, when you process a typical Vendor Expenses Summary report, these capitalized expenditures, will not be on this report.

To get these types of expenditures on this report:

- In QuickBooks Desktop, you can simply filter this report to include exactly the accounts (expense and asset) you want to see on this report.

- In QuickBooks Online, you will need to create a completely different and customized report from scratch.

Finally, here is a simple example of a Vendor Expenses Summary report:

Note: AccuraBooks is a bookkeeping firm only, so please consult with your C.P.A. for verification and clarification about the contents of this article.